I Can’t Pay My Bills! Which Spouse Is REALLY In the Better Financial Position?

Posted July 26th, 2016.

Categories: Family Law, The Calculating Lawyer.

Husband and Wife have split up. Now they’re living in two households. And each of them is complaining that they don’t have enough money to pay their bills. Molly, the wife, wants alimony because she cannot pay her rent or her credit card bills in order to sustain her marital lifestyle. Henry, her husband, says he has his own debts to worry about. He says he cannot pay Molly’s request for alimony and sustain his own lifestyle at an equivalent level at the same time.

How do we determine which party’s debt obligations are greater in the context of their earnings? One approach is to look at the ratio of take-home pay to debt-service charges. This ratio determines how well one’s net wages cover her monthly payments of principal and interest on credit cards and loan accounts.

Debt service can be calculated by determining the sum of all payments due on loans, credit accounts, and other debts for a fixed period of time. In fact, some financial statements required by divorce courts provide a line item for debt service under the listing of the party’s personal expenses. In other jurisdictions, it may be necessary to ascertain the debt service from several line items on the financial statement or other disclosure document.

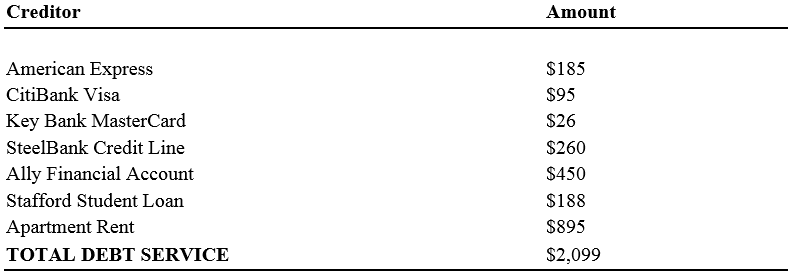

Let’s assume that Molly has a monthly debt service of $2,099, calculated as follows:

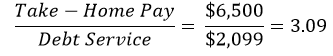

If Molly nets $6,500 in monthly wages, with a total debt service of $2,099, then her take-home pay-to-debt service ratio would look something like this:

In other words, Molly would have a ratio of 3.09. This means that she has $3.09 in take-home pay for every $1 dedicated to paying credit card bills and loan accounts. Not bad. In fact, a ratio above 3 is considered favorable; under 2 is considered risky. For Molly and her attorney, the goal is to obtain a higher ratio.

Of course, the ratio can be utilized and compared in a number of different ways. If, for example, Molly has obtained a wage garnishment order that withdraws alimony and child support from Henry’s paycheck each week, then Henry’s take-home pay will be correspondingly lower. If the amount of the support payment is too high, and if Henry’s ratio drops considerably lower that Molly’s, Henry may choose to challenge the support orders or other aspects of the divorce case.

So, for example, assume that Molly has a take-home pay-to-debt service ratio of 3.09 and Henry has a ratio of 6.4. As a measure of liquidity, this comparison would suggest that Henry is in a much stronger position. This could be attributable to Henry’s higher paycheck alone. Or perhaps Henry has fewer credit card bills. In matrimonial negotiations, such a disparity in ratios presents an opportunity for Molly’s attorney. A significant disparity between take-home pay-to-debt service ratios can be addressed from several approaches, one of which considers the numerator (take-home pay), and one which considers the denominator (debt service).

Approach #1: Modifying Support

By requiring Henry to pay more spousal support or child support, Molly can essentially reduce Henry’s take-home pay, and in so doing reduce his take-home pay-to-debt service ratio. If Molly were to receive an additional infusion of net cash (after payment of any taxes on alimony), her ratio would correspondingly increase. For example, an additional monthly payment of $1,000, effectively increasing Molly’s take-home pay to $7,500, would boost her ratio to 3.57.

Suppose Henry had a significantly lower take-home pay-to-debt service ratio of 1.2. This means that his paycheck would provide only $1.20 to cover every dollar of debt repayment he was obligated to make – a very small cushion. Henry’s attorney would thus agree that Henry’s support obligations should be reduced because he is in a far less liquid condition than Molly. By lowering Henry’s support obligations, Henry’s take-home pay would now increase, and his ratio would correspondingly grow.

Approach #2: Reducing Debt Service

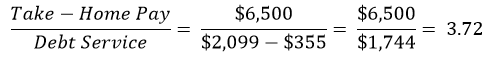

If take-home pay cannot be adjusted, then the ratio can be modified by reassigning debt between the spouses. If Molly then reduces her debt service, even without altering her take-home pay, she will enjoy a higher ratio. So, for example, if Molly’s attorney can persuade Henry’s attorney that Henry should assume responsibility for the CitiBank Visa and SteelBank Credit Lines, he will have shifted $355 in debt service to Henry. By reducing Molly’s debt service by this amount, Molly’s new take-home pay-to-debt service ratio would be 3.72.

Now, Molly has $3.72 to cover every $1 of debt.

The opposite scenario is also true. If Henry had a lower ratio of 1.2, as suggested under Approach #1 above, and if he was unable to persuade his wife or a judge to lower his support obligations, he might wish to turn his attention toward reassigning his debt service. By transferring one or more of his credit obligations or monthly bills to Molly, Henry would reduce his debt service, while increasing his ratio, and Molly would increase her debt service, while reducing her ratio.