Lottery Winner’s Dilemma: Lump Sum or Annuity? Calculating the Present Value of an Annuity.

Posted June 9th, 2016.

Categories: The Calculating Lawyer.

What if you won the lottery tomorrow, and your jackpot was $60,000 a year for 15 years? That would come to $900,000! But, of course, you would have to wait 15 years to collect it all. What if you could take a smaller amount today in a single lump sum payment?

What amount today would be worth trading away $60,000 for 15 years?

The question can be answered by using the formula for the Present Value of an Annuity. Assume the interest rate is 4%.

You will need a financial calculator to perform this calculation. Online financial calculators can be downloaded for free from a number of sites, such as www.investopedia.com

To calculate the answer using a financial calculator, input the interest rate (4%), the number of time periods (15 years) and the payment amount ($60,000). You should obtain a present value of $667,103.25.

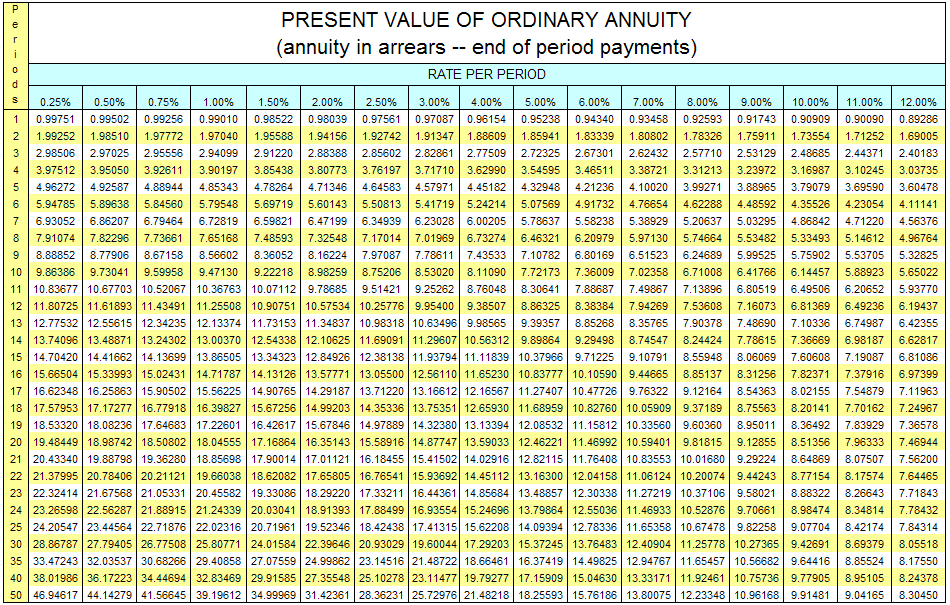

If you do not have a financial calculator, you can consult an annuity table, which sets forth the pre-calculated compound interest rates for each period of years at each basic interest rate. Annuity tables are widely published and widely available online (See, for example, the table published at http://www.annuitylibrary.com/glance_annuities_table.htm). A typical annuity table depicts the years running down the first column and the rates of interest running across the top row. By finding 15 years on the first column and 4% on the top row, and drawing the points together, you can obtain a pre-calculated compound interest rate of 11.1184. This rate should then be multiplied times the payment amount. In the example above, we would multiple 11.1184 times $60,000 which yields a present value of $667,104 (nearly exactly the same result as using a financial calculator).

What this means is that you should not accept less than $667,104 today in lottery proceeds in exchange for passing up the annuity payments of $60,000 for the next 15 years.

Let’s try another application of the formula for a Present Value of an Annuity. Assume that an insurance carrier has offered $600,000 to settle a lawsuit or, as an alternative, a yearly payment of $45,000 over 20 years. Assume the interest rate is 3%. Which is the best alternative – the lump sum payment of $600,000 or the 20 annual payments of $45,000?

To arrive at the answer, we need to know the present value of 20 annuity payments of $45,000 based on 3% interest. By plugging the interest rate (3%), the number of time periods (20) and the payment amount ($45,000) into a financial calculator, we find that the present value of the annuity is $669,486.37. Or, by using an annuity table, we find that the pre-calculated compound interest rate for 3% over 20 years is 14.8775. We then multiply 14.8775 times $45,000 to obtain the present value of $669,487.50 (again, quite close to the result obtained by using the financial calculator).

Therefore, we should reject the insurance carrier’s offer of $600,000 to settle the case in a lump sum. The annuity payments have a present value of $669,487.50 and therefore present the better deal. [Or, if the insurance carrier wishes to settle the case today with single lump sum payment, then your bottom line should be greater than $669,487.50].