Alimony: How Much Can I Pay Now To Buy My Way Out of It Forever?

Posted July 20th, 2016.

Categories: Family Law, The Calculating Lawyer.

Oh no! The ugly “A” word —Alimony. It may be tax-deductible to the party paying it, and taxable to the party receiving it, but it’s controversial nevertheless. The spouse who is obligated to pay alimony often objects to the process of writing weekly or monthly checks to his ex-spouse, especially if his own financial situation is not improving as time marches on.

What if he could pluck down a certain amount of money today and buy her off? How much money today — paid all at once — would be enough to buy out a long-term alimony award? Let’s take a look.

Discounted Cash Flows

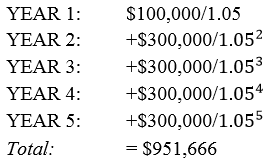

Assume Husband will make a deal by which a certain amount of his own money can be invested at 5% to generate a cash flow to his wife over the next five years. The parties negotiate long and hard. Wife proposes that she receive a cash flow of $100,000 in year 1, $300,000 in years 2, 3 and 4, and $100,000 in year 5. She demands that Husband invest one million dollars to fund the cash flows which she seeks. Husband tells his lawyer that he has no objection to Wife’s yearly cash flows, but seeks the lawyer’s advice as to whether a $1 million investment is appropriate. How far will $1 million stretch, at 5% interest, over five years, given the precise payout schedule Wife wants?

The inquiry is answered by the discounted cash flow procedure.

Step 1: Add the interest rate to 1. Thus, 1 + 05 = 1.05

Step 2: Use 1.05 for year 1. For year 2, use 1.05 to the second power. For year 3, it’s 1.05 to the third power…and so forth.

Step 3: Divide the amount to be paid in each year by the finalized interest rate. Thus, in year 1, we divide $100,000 by 1.05. In year 2, we divide $300,000 by 1.1025 (which is 1.05 to the second power). In year 3, we divide $300,000 by 1.1576 (which is 1.05 to the third power)…and so forth.

Step 4: Add each year’s totals together.

Follow the complete formula below:

So, the net present value of the cash flows to the Wife would be $951,666.

In other words, Husband will need to invest only $951,666 to meet Wife’s five-year cash flow proposal, not $1 million. Demonstrating how the discounted cash flow procedure works could thus save Husband over $48,000.

Permanent Alimony (Perpetuities)

Husband doesn’t want to write alimony checks, but the parties agree that Wife qualifies for permanent alimony. The parties agree that Wife should receive $100,000 per year for life. If Husband has a significant estate and is able to invest a lump sum at 10%, how much should he invest to generate cash flows of $100,000 per year for Wife? Answer: $1 million. The formula is simple: Divide the Wife’s annual amount by the interest rate: $100,000 divided by .10 = $1 million.

The formula is known as the present value of a perpetuity because it continues in perpetuity. Thus, in structuring a deal, the parties must address the eventual pay-out of the corpus ($1 million) upon the payee’s death (or upon her remarriage, as the case may be). Unlike alimony, the payment of a perpetuity to generate annual lifelong cash flows to the Wife will not automatically terminate upon the death of the Husband.

What if Husband agreed to pay Wife $50,000 per year for life? Assume that a 6% interest rate applies. How much should Husband invest now to guarantee annual payments of $50,000.

$50,000/0.06 = 833,333.33

In this scenario, Husband should invest $833,333.33, assuming a stable 6% interest rate.

Limited Term Alimony (Present Value of an Annuity)

Assume that Wife is seeking $2,000 per month in alimony, and Husband is not conceptually opposed to the amount. Husband does not want to write the monthly checks. Husband consults his attorney about converting one his assets to an account or an investment to fund the monthly alimony payments. The parties negotiate, and they agree that Wife would get $2,000 per month in limited duration alimony for a period of 10 years. How much must Husband deposit now to fund the payments for the 10-year term?

There are eight steps:

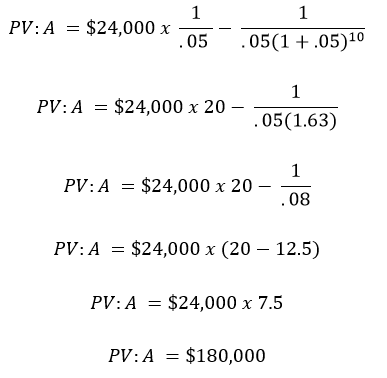

Step 1: Annualize the alimony. In other words, $2,000 per month equals $24,000 per year.

Step 2: Determine the available interest rate. Let’s assume 5%. Add the interest rate to 1, creating the multiplier of 1.05.

Step 3: Raise 1.05 to the tenth power, because 10 is the number of years that the limited duration alimony will be paid. Thus, ![]()

Step 4: Multiply the interest rate (.05) by 1.63, which equals .08.

Step 5: Divide 1 by .08, which equals 12.5.

Step 6: Divide 1 by the interest rate (.05). Thus, 1 ÷ .05 = 20.

Step 7: Subtract 12.5 (Step 5) from 20 (Step 6). Thus, 20 – 12.5 = 7.5.

Step 8: Multiply the annual alimony payment ($24,000) by 7.5. Hence, $24,000 x 7.5 = $180,000.

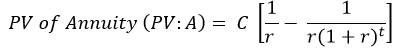

Conclusion: In order to fund a limited term of alimony of $2,000 per month for 10 years, Husband must set aside $180,000 today at 5% interest. This calculation is often known by financial experts as the present value of annuity. Here is the official formula:

where C equals the cash or alimony which the Wife will be receiving annually, r equals the interest rate, and t equals the number of years in the term. Let’s do the math: